WINEGROWERS in the Murray Darling and Swan Hill regions are facing a bittersweet outcome from the 2025 vintage, with improved weather and harvest yields offset by continued financial pressure, especially in the red grape sector.

According to the Wine Grape Crush Report – 2025 Vintage, the total wine grape harvest for the region reached 329,621 tonnes, a 17 per cent increase over 2024 and 5 per cent above the five-year average.

However, it still marks the fourth-smallest reported crush in at least a decade.

Growers expressed frustration over red grape prices, which “remain well below the cost of production”, despite some improvement in demand.

“Many [are] yearning for a more viable industry,” the report states.

“The prevailing advice ahead of the season was bleak: “Growers should not expect any meaningful improvement for red varieties in 2025.”

White grapes fared better in both pricing and demand, with the report noting that expectations were for relative stability, which largely materialised.

Unlike previous years, the 2025 growing season was largely free of major weather disasters. Only “a couple of disease alerts” were recorded via the GrapeWatch/GrowCare platform, and most of the region avoided significant damage.

That said, “pockets of frost” and “spasms of storm and hail damage” caused isolated devastation.

By comparison, the Murray Valley “fared much better than our two other inland counterparts”, with the Riverina hit hard by both frost and storms, and the Riverland also suffering significant frost damage.

The dry year required a return to standard irrigation practices. While water costs were manageable, “massive increases in pumping expenses” added to growers’ financial stress.

There was a noticeable increase in winery activity, with more wineries seeking fruit in 2025 than in recent years.

However, this uptick in demand didn’t result in prices that cover costs for many red grape growers.

“Generally, the improved demand translated into improved prices but unfortunately, red prices were still below the cost of production, challenging growers’ resilience to remain in the industry,” the report warned.

Roughly 25,000 tonnes of grapes were listed for sale (51 per cent whites, 49 per cent reds), down from 27,000 tonnes in 2024. Around 1000 tonnes went unsold, with an additional 750 tonnes removed from the register due to low pricing or poor quality.

Harvest began unusually early on January 6, and was completed within seven to eight weeks, compared to the typical 10-week window. This “quickness” created logistical strains for wineries managing simultaneous red and white intake.

Nevertheless, quality was high. Winemakers noted that the 2025 fruit “will see some exceptional wines produced this year”.

Notably, Pinot Gris, Sauvignon Blanc, and Chardonnay stood out among the whites for their “bright and fresh wines, exhibiting excellent varietal characteristics”, while Shiraz and Cabernet Sauvignon were the top-performing reds, with Cabernet showing “superb colour”.

About 25,000 tonnes of fruit were diverted to non-wine products, sold at low prices but with short payment terms, offering some cash flow relief for growers.

Nationally, the 2025 vintage totaled 1.57 million tonnes, up 11 per cent from 2024 but still 8 per cent below the 10-year average.

MD-SH accounted for 23 per cent of the national crush, contributing 30 per cent of all white wine grapes and 16 per cent of reds.

Notably, purchased grapes made up 70 per cent of the MD-SH crush, unchanged from 2024. However, the volume of purchased grapes from the New South Wales side of the region rose sharply, up 114 per cent, while winery-owned fruit crush declined by 5 per cent.

Red grape crush rose 23 per cent, while whites increased by 13 per cent, reducing the white share of the total from 66 per cent to 62 per cent. Despite the drop, this is still well above the national white average of 47 per cent.

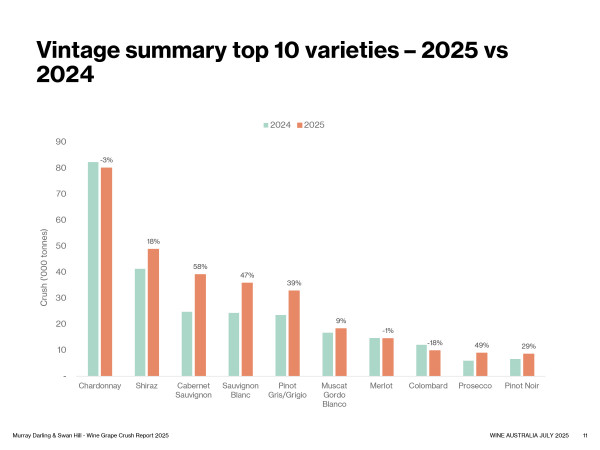

Among varieties, Chardonnay remained the largest at 80,068 tonnes, though it declined 3 per cent year-on-year. The biggest gains came from Cabernet Sauvignon (up 58 per cent), Prosecco (up 49 per cent), and Sauvignon Blanc (up 47 per cent). Prosecco entered the top 10 varieties, edging out Semillon.

The 2025 vintage paints a complex picture: good yields, high-quality fruit, and signs of increased demand – but persistent economic strain, particularly for red grape growers.

As the report concludes, despite more favorable growing conditions, “many [growers are] yearning for a more viable industry”.

Without sustainable pricing, the future remains uncertain for many across the Murray Darling and Swan Hill regions.